Meta Platforms Inc., the parent company of Facebook, Instagram, WhatsApp, and Messenger, is one of the most talked-about technology companies in the world. Its stock, commonly known as Meta stock, attracts investors due to strong user growth, digital advertising revenue, and increasing focus on AI and future technologies.

If you’re thinking about investing, this Meta Stock Buying Guide will help you understand what to check, how to evaluate the stock, and whether it may suit your investment goals.

What Is Meta Stock?

Meta stock represents shares of Meta Platforms Inc., a US-based technology company listed on the NASDAQ stock exchange under the ticker symbol META.

When you buy Meta stock, you become a small shareholder in the company, meaning your investment value can rise or fall based on the company’s performance and overall market conditions.

About Meta Platforms Inc.

Meta Platforms Inc. operates some of the world’s most popular social media and communication platforms. The company mainly earns revenue through digital advertising, while also investing heavily in artificial intelligence (AI), virtual reality, and long-term technology innovation.

Meta’s strong global presence and massive user base make it a key player in the tech industry.

Meta Stock Buying Guide: Key Factors to Check Before Investing

Before buying Meta stock, it’s important to evaluate these factors carefully:

1. Company Financial Performance

Check Meta’s:

- Revenue growth

- Profit margins

- Quarterly and annual earnings reports

Strong financial performance often reflects stability and growth potential.

2. Business Model & Growth Plans

Meta’s future growth depends on:

- Advertising demand

- AI-powered tools and platforms

- Innovation in digital communication

Understanding how the company plans to grow is essential for long-term investors.

3. Market Competition

Meta faces competition from:

- Other social media platforms

- Emerging digital advertising companies

Competition can impact user engagement and revenue growth.

4. Risk Factors

Like all stocks, Meta stock carries risks such as:

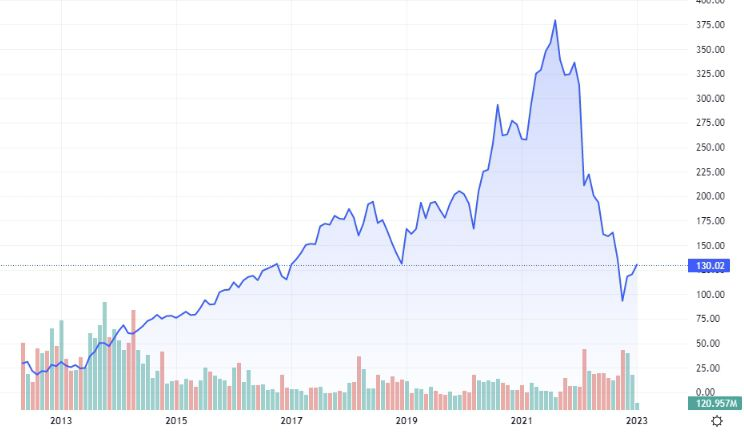

- Stock market volatility

- Regulatory and privacy concerns

- Changes in user behavior

Always assess your risk tolerance before investing.

Is Meta Stock Suitable for Beginners?

Meta stock can be considered by beginners who:

- Prefer long-term investing

- Are comfortable with moderate to high risk

- Want exposure to global technology stocks

Beginners should avoid short-term speculation and focus on learning basic stock market principles first.

How to Buy Meta Stock (General Overview)

This is an educational overview, not investment advice:

- Choose a platform that provides access to US stocks

- Complete account verification as required

- Research Meta stock thoroughly

- Decide your investment amount based on your budget

- Monitor your investment regularly

Always rely on your own research or professional guidance.

Pros and Cons of Meta Stock

Pros

- Strong global brand value

- Large and active user base

- Consistent advertising revenue

- Investment in future technologies

Cons

- Price fluctuations in the stock market

- Regulatory and data privacy challenges

- Dependence on advertising income

Bitcoin Buying Guide 2026: How to Invest in BTC Safely & Smartly

Title: “Bitcoin Investment Strategies and Historical ROI” Description: A bar chart showing potential ROI for…

Home Loan Guide for First-Time Buyers: Everything You Need to Know

Buying your first home is one of the biggest financial milestones in life. While the…

Is This the Right Time to Buy Property? Latest Real Estate Market Update

Buying property is one of the biggest financial decisions in life. With changing interest rates,…

Common Mistakes to Avoid

- Buying based on hype or social media trends

- Ignoring company fundamentals

- Investing without a clear long-term plan

- Putting all savings into a single stock

Smart investing is about discipline and research.

Final Thoughts

Meta stock remains a popular choice among technology investors due to its strong market position and future growth potential. However, every investor’s financial situation and risk appetite are different.

Use this Meta Stock Buying Guide as an educational resource, take time to analyze the stock, and make informed decisions.

Disclaimer

This article is for educational and informational purposes only and should not be considered financial advice. Stock market investments are subject to market risks. Always do your own research or consult a qualified financial advisor before making any investment decisions.

#MetaStock #MetaPlatforms #StockMarket #InvestmentGuide #Anslation #Carrerbook #FinanceBlog #USStocks #TechStocks #BeginnerInvesting #LongTermInvestment

FAQs

Q1. What is Meta stock?

Meta stock represents shares of Meta Platforms Inc., a global technology company.

Q2. Is Meta stock good for long-term investment?

Meta stock may suit long-term investors who understand market risks and believe in the company’s future growth.

Q3. Can beginners invest in Meta stock?

Yes, beginners can consider it, but only after proper research and understanding of risks.

Q4. Is Meta stock risky?

Like all stocks, Meta stock involves risk due to market fluctuations and business factors.